$2,099.20 per Gigabyte

Wednesday, May 9, 2018 at 12:18PM

Wednesday, May 9, 2018 at 12:18PM This one has a relationship to the political bullshit tornado we all find ourselves in, but it is personal as well.

I was prompted to write this by a section of the Slate Money podcast discussing the latest attempt by the wireless phone companies T-Mobile and Sprint to combine. They have been trying out various acquisition schemes on the regulators and financiers for the past decade. One of the main objections to this would be the reduction of the wireless players to three, Verizon, AT&T, and the Sprint/T-Mobile combo, thus reducing competition.

Another motivation is the recent revelation that in 2017 AT&T dumped $200,000 into the coffers of Essential Consulting, a shell company run by Trump’s fixer, Michael Cohen. As far as anyone can tell, Essential was brought into existence to handle the money to pay off Stormy Daniels. Supposedly a real estate consulting firm, it had no employees, no offices, no website, and essentially no activity except the suspicious transfers of six-figure sums from Russian oligarchs and large corporations and to Ms. Daniels and Cohen himself. AT&T was trying for its own merger at the time the money was transferred, in four $50k chunks.

Unrelated to my wireless thesis, but still interesting, the pharmaceutical giant Novartis made four payments of $99,980 to Essential just before Trump had a dinner meeting with the CEO of Novartis at the Davos conference in January 2018. Which is not suspicious at all. Here’s the executive summary of the report.

Back to wireless service and monopolistic practices.

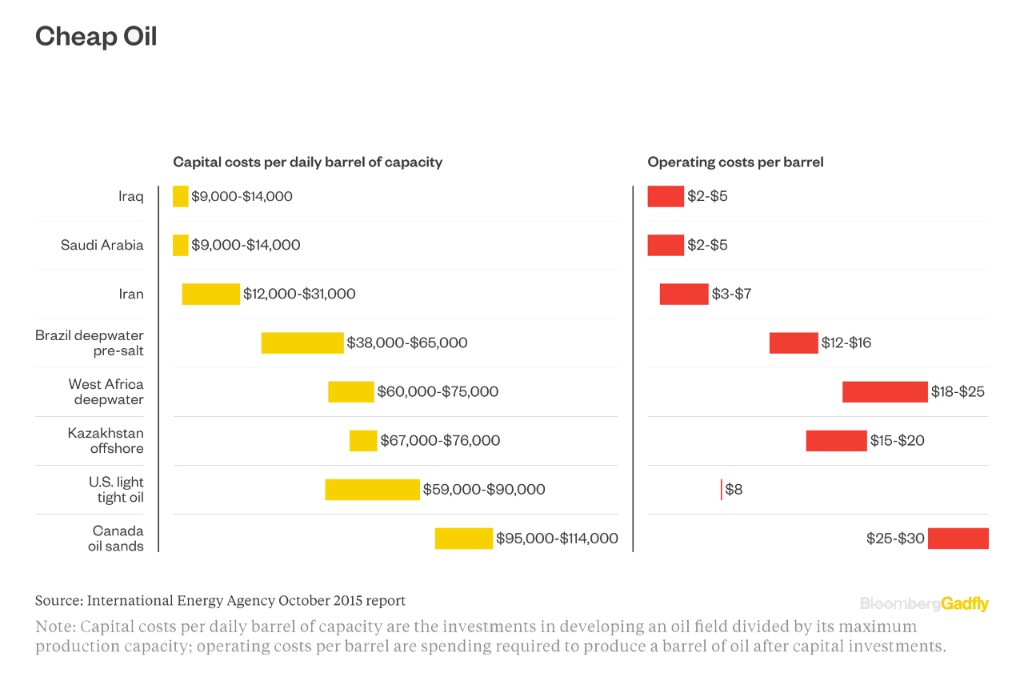

I have wireless phone service from Verizon. I pay $35 a month for two gigabytes of data. This is extortionate, considering all the other fees I pay them, and compared to prices available in Europe and the UK. On the eastern side of the Atlantic there is no such thing as a locked phone. If you want service in the UK you can walk into any corner shop, buy a SIM card to stick in your phone, and get a gigabyte and a thousand minutes for the equivalent of about $12.50. That’s it. No other fees. You can buy more time and data for a similar price. If you don’t like the service you can walk into a shop, buy a SIM for a different service provider, stick it in the phone, and pitch the old one in the trash. Just like that, with no screwing around.

But that’s not the worst part of our American wireless duopoly (AT&T/Verizon). I do a lot of traveling up to near the Canadian border. Where I go the best wireless reception is from towers in Canada. As I drive near to the border my phone beeps and I get a message from Verizon. It informs me that I am now on Canadian roaming (even though I haven’t crossed the border) and that data will now cost $2.05 per megabyte. $2.05 doesn’t sound so bad until you multiply it by 1024 to get the price per gigabyte, which is $2,099.20. So, picking up a Canadian cell tower has increased my price per gigabyte from $17.50 to $2,099.20. I have spoken with a Verizon customer service representative, who unsurprisingly was at a loss to explain why radio waves increased in price by a factor of 120 when they crossed the line.

Oh, but Verizon has a solution. You can sign up for their Canadian roaming plan. It works like this: Once signed up, if you use your phone in Canadian cell range you get charged a $5 fee for 24 hours. You get to use your regular minutes and data at the regular price. If you dial your phone at 9:04 one morning you have until 9:04 the next morning before another $5 charge is applied.

On a simple monthly basis this would be like paying an extra $150 for my cellular service, which is still robbery. If you consider the possibility of using some tiny amount of data in a day, the cost per gigabyte could be well over $2,099.20.

AT&T has similar plans and pricing, in case you are wondering.

The existence of the Canadian roaming plan raises the obvious question of why Verizon charges $2,099.20 per gigabyte when it also seems able to afford roughly 1/20th of that under the roaming plan.

Of course, the answer is, “Because they can.” The FCC is essentially a captured agency, the antitrust division of the Department of Justice is a joke, and Verizon and AT&T control 70% of the wireless market between them. Verizon is ready and willing to gouge the unprepared and then gouge them again for a lesser amount once they realize they have been had. It’s not going to change until the big wireless carriers are regulated like the near-monopolies they are.